Wednesday, July 15, 2020 is the due date for Georgia Individual Income Tax

- Tax returns must be received or postmarked by the due date.

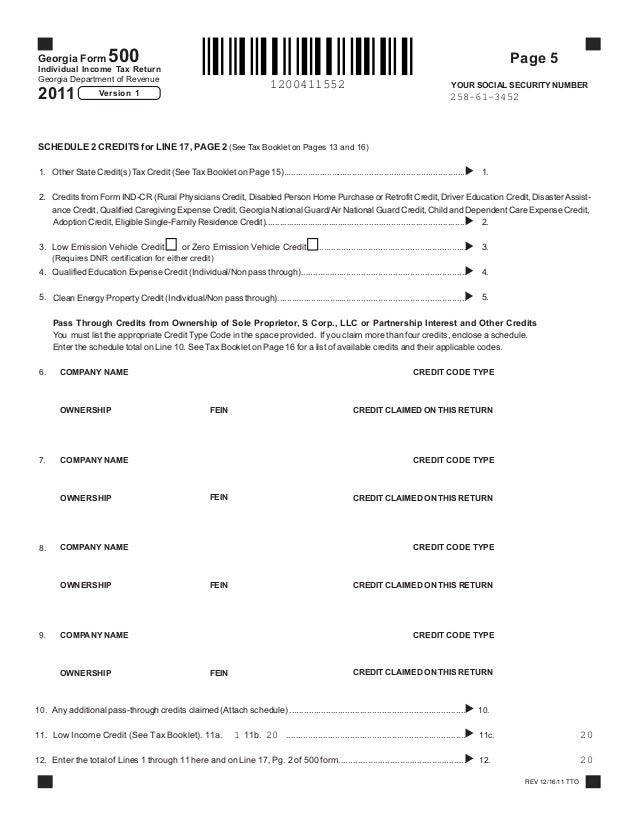

- Form 500-EZ is a Georgia Individual Income Tax form. Like the Federal Form 1040, states each provide a core tax return form on which most high-level income and tax calculations are performed.

- You have been successfully logged out. You may now close this window.

- Apply taxable income computed in step 7to the following table to determine the annual Georgia tax withholding. Tax Withholding Table Single. If the Amount of Taxable Income Is: The Amount of Georgia Tax Withholding Should Be: Over: But Not Over: Of Excess Over: $.

Form 500-EZ is the short form for filing your individual income tax return. Persons with very simple taxes may file this form. For more information about the Georgia Income Tax, see the.

Do I have to file taxes with the state of Georgia? Yes, if:

- You are required to file a Federal Return

- You have income subject to Georgia income tax that is not subject to Federal income tax

- Your income exceeds the standard deduction and personal deductions described under filing requirements in the Individual Income Booklet (IT-511)

What forms do I use and where do I get them?

- IT-511 Individual Income Tax Booklet contains instructions, forms and tax tables

- Form 500EZ and Form 500 are the Individual Income Tax Return forms in Georgia. If you do not qualify to use Form 500 EZ then you will need to use Form 500

Can I use the 'EZ' Form (500EZ)? Yes, if:

- Your income is not over $99,999 and you do not itemize deductions

- You do not have any adjustments to your Federal Adjusted Gross Income

- You are not 65 or older, or blind

- Your filing status is single or married filing joint and you do not claim any exemptions other than yourself and/or your spouse

- You lived in Georgia the entire year

- You are not claiming an estimated tax credit

Otherwise, use Form 500.

Can I file Electronically?

Yes! File online using approved tax software or you may be eligible to File for Free.

You may also download the tax forms, save them and fill them out on your computer. Once completed, print and mail them.

Filing electronically will get your return to you the fastest. Handwritten forms take the longest to process.

What if I need to file an extension?

- You must file an extension by July15, 2020

- This is NOT an extension to pay. Use Form IT-560 Payment Voucher with your extension payment

- You can pay online at the Georgia Tax Center. Login and look for 'Make a Quick Payment'

Where do I mail tax forms?

If you owe tax, mail your return and payment along with Form 525-TV to the address on the form. Make your check or money order payable to the Georgia Department of Revenue. Need other mailing addresses?

Ga Tax Booklet 500ez

Avoid Delays

Georgia Form 500ez Instruction Booklet

- Double-check your return

- Are SSN or ID numbers correct?

- Check your math

- Use the correct tax table

- Sign and date your return

Quick Links

Payment Options

Filing Requirements

Do you qualify to file for free?

Download this year's tax booklet (IT-511)